As households brace for the economic challenges of a post-pandemic world, the Consumer Price Index (CPI) provides crucial insights into the financial pressures they face. A close examination of the past year’s CPI reveals a clear and sustained upward trend, painting a vivid picture of the inflationary environment that consumers are navigating.

The Steady Climb of the CPI

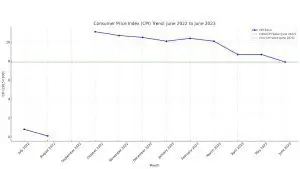

The Consumer Price Index is a critical barometer of the cost of living. It measures the average change in prices over time that consumers pay for a basket of goods and services. As the graph below showcases, there has been a consistent rise in the CPI over the past year.

From June of the previous year to June of the current year, the index has jumped from around 121.8 to approximately 131.5 . This ascent signifies a nearly 8% increase, a significant inflationary push that impacts nearly every consumer.

Behind the Numbers

Several factors could be driving this upward trajectory:

- Supply Chain Disruptions: The global pandemic has disrupted supply chains, creating shortages in various sectors. Reduced availability often translates to increased prices.

- Increased Demand: As restrictions lift and economies rebound, pent-up demand from consumers can drive prices up, especially if supply hasn’t caught up.

- Global Economic Factors: Fluctuations in oil prices, currency values, and international trade dynamics can all influence the CPI.

Implications for the Average Consumer

For the everyday consumer, a rising CPI means that their purchasing power is eroding. The money in their wallets doesn’t stretch as far as it used to. Whether it’s grocery shopping, trips to the cafe, filling up the car with petrol, or even just enjoying a nightclub, everything feels a tad more expensive.

For those on fixed incomes, such as retirees or those reliant on certain types of benefits, the impact can be even more pronounced. Their income might remain static, but the world around them is getting more expensive.

What’s Next?

While the past year’s trend is evident, predicting the future trajectory of the CPI is more complex. Will the index continue its upward march, stabilize, or even retreat? Much depends on how global and local economies respond to the lingering effects of the pandemic, and how quickly supply chains can adapt and recover.

For now, consumers would do well to brace for the possibility of further inflation, at least in the short term. This might mean tightening the belt a bit, looking for bargains, or even rethinking some discretionary expenses.

Final Words

The rising CPI over the past year underscores the economic challenges of our times. It’s a numeric testament to the complex interplay of global events, economic policies, and consumer behaviour. As we move forward, this index will remain a critical tool for gauging the health of our economy and the pressures on our wallets.