The Retail Roller Coaster: Analysing the December 2023 Sales Plunge

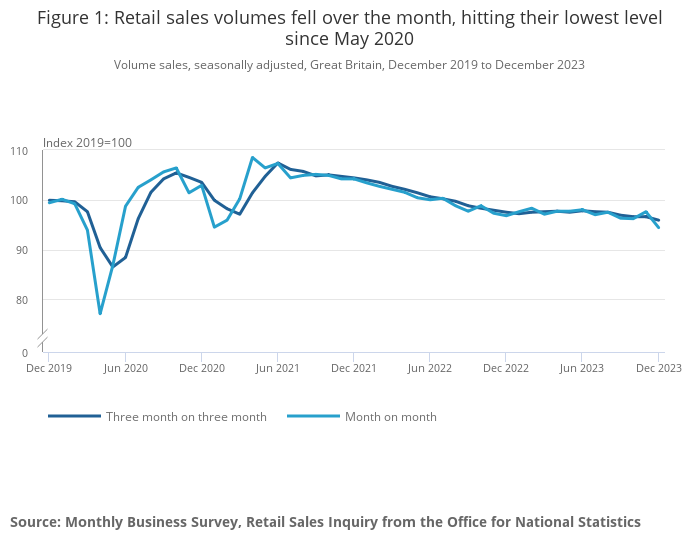

The latest figures on retail sales in December 2023 have sent shockwaves through the industry, revealing a sharp decline of 3.2%, marking the largest monthly fall since the early days of the COVID-19 pandemic in January 2021. In this deep dive, we unpack the key insights from the report, exploring the quarterly landscape, the performance of different sectors, and the significant shift in consumer behaviour.

1. A Dismal December

The numbers speak for themselves – a 3.2% drop in sales volumes in December 2023, a stark reversal from the 1.4% growth experienced in November. The plunge is reminiscent of the challenging times at the onset of the pandemic, underlining the fragility of the retail sector in the face of unforeseen circumstances.

2. Quarterly Perspective

Zooming out to the quarterly picture, the trend continues with a 0.9% fall in sales volumes in the three months leading up to December 2023. This decline reflects the broader challenges faced by retailers, hinting at potential shifts in consumer sentiment and spending habits.

3. Sectoral Showdown

Breaking down the numbers by sectors, non-food store sales volumes plummeted by 3.9% in December, following a surge of 2.7% in November driven by Black Friday and widespread discounts. Food store sales volumes also suffered a significant hit, falling by 3.1%, in contrast to a 1.1% rise in November. The online retail sector, often considered a stronghold, experienced a 2.1% decrease in sales volumes in December, compounding the challenges faced by e-commerce players.

4. Automotive Woes

Adding to the complexity, automotive fuel sales volumes declined by 1.9% in December, following a modest rise of 0.8% in November. This dip in automotive fuel sales could be indicative of broader economic concerns and changing consumer behaviours related to transportation.

5. Annual Reflection

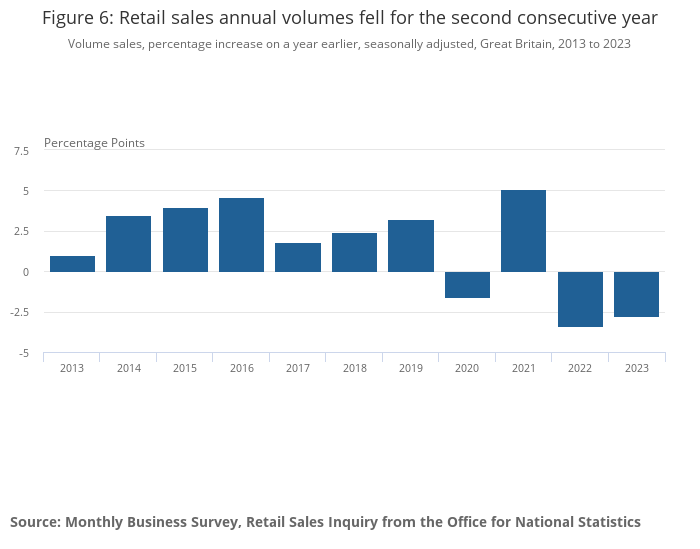

On an annual basis, retail sales volumes witnessed a 2.8% decline in 2023, reaching their lowest level since 2018. The consistent dip over the past two years raises questions about the long-term resilience of the retail sector and prompts a critical examination of the factors contributing to this downward trend.

Gary Smith, UK & EU Sales Expert at Power EPOS, offers insights on the December 2023 retail sales downturn. According to Gary, “The substantial decline in December sales volumes is a poignant reminder of the industry’s vulnerability, especially in the wake of external disruptions. The quarterly contraction and sector-specific challenges underscore the urgency for retailers to reassess their strategies and enhance adaptability. The drop in automotive fuel sales hints at evolving consumer behaviours, demanding a holistic approach to meet changing needs.”

Gary emphasises, “Online retail, though resilient, faced unexpected headwinds. The shift in consumer spending patterns necessitates a renewed focus on digital strategies. As we navigate these turbulent waters, a proactive approach to understanding and addressing consumer trends will be crucial for the industry’s resurgence.”

6. Online Retail Under Pressure

Despite being a bastion of stability, online retailing faced headwinds with a 2.1% drop in sales volumes in December 2023. The proportion of online sales rose slightly from 26.6% to 27.1%, highlighting the industry’s ability to weather the storm but also showcasing the overall challenges faced by the retail sector.

7. Unpacking the Data

Delving into the detailed statistics, our analysis reveals that department stores, clothing stores, household goods stores, and other non-food stores collectively experienced a 3.9% decline in sales volumes in December 2023. This drop is attributed to consumers purchasing gifts earlier than usual in November, aligning with broader societal trends.

8. A Year in Review

The broader context is crucial – retail sales volumes fell by 2.8% in 2023, marking the second consecutive year of decline after a 3.4% fall in 2022. This extended period of contraction places the industry at a critical juncture, necessitating a strategic reevaluation of business models and consumer engagement strategies.

9. The Online Landscape

Analysing online sales statistics, the report reveals a 1.7% drop in online spending from November to December 2023. However, the proportion of online sales increased to 27.1%, surpassing pre-pandemic levels. This trend indicates a fundamental shift in consumer preferences, emphasising the importance of a robust online presence for retailers.

Conclusion

The December 2023 retail sales report paints a challenging picture for the industry, emphasising the need for adaptability and resilience. As consumer behaviour continues to evolve, retailers must navigate the complexities of a changing market landscape. This analysis serves as a call to action, urging businesses to rethink strategies and embrace innovation to thrive in an uncertain future. Stay tuned for updates as the retail sector navigates these turbulent waters.